After the Income Tax Department has

processed the income tax return, it will send an intimation notice to taxpayers

under section 143(1) of the Income Tax Act 1961. The individuals who

have filed their Income Tax Return for the financial year 2018-19 will receive

the intimation on the registered e-mail Address same as registered in the

e-filing account. The notice will inform you whether the income tax computation

in the ITR filed by you matches as per the record.

This process includes the estimation

of any errors, internal and external inconsistencies, tax & interest

calculation and verification of tax payment, etc. Therefore, it is more like a prima

facie valuation by the tax officials to check whether the information is

accurate or not. This whole process is

called an assessment, in such cases, if there is any mismatch or the department

is unable to verify the content and information, it may issue a notice. Previously, these notices were sent by post

but currently, they are mailed and also uploaded on the e-filing portal.

If any taxpayers who have applied for

ITR filing and do not receive

the intimation notice, it means, your tax return acknowledgment will serve as

the department’s acceptance of your return.

What to do when you receive an

intimation notice?

You might be wondering about what you

should do when you receive intimation notice. Well! First, the tax assessee

should check if there is any difference in the reports or whether the

department has accepted the income and tax numbers filed by you. There are

certain steps through which you can check the faults. In case you haven't found

any difference then no action required. However, if the figures do not watch,

you should carefully check the line in which you have entered the amount

considered by the department differs from what you have submitted.

Here are the steps about how to get

the intimation notice-

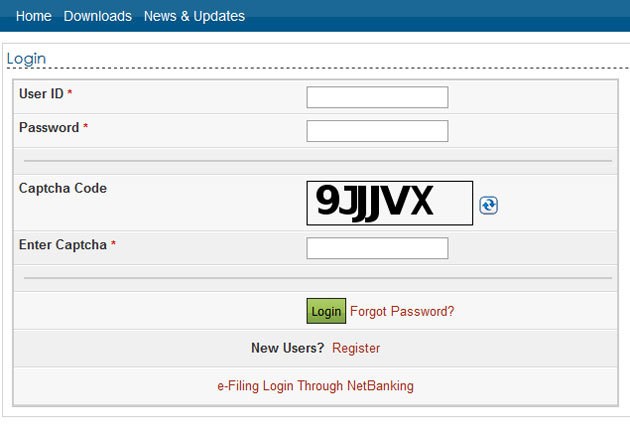

Step 1: Visit income tax

india efiling login (www.incometaxindiaefiling.gov.in)

Step 2: Log in to your account. The user ID is

your PAN number.

Step 3: In the 'My Account' tab select, the

service request option

Highlights of what intimation notice

will show under section 143(1)-

Intimation notice received by you

under section 143(1) will show some of the discussed points in the below-

·

Your income details, deductions claimed and tax calculations

match with the tax department's assessments and calculations: In this case the

notice will show both tax payable and refundable as zero.

·

Additional tax demand notice: When, as per the tax

department's assessment, you have not added a particular

·

As per the income tax department's assessment, if you have

paid additional taxes compared to your actual tax liability, a income tax refund

is due to you.

Meanwhile, in case you have not

received the intimation by the tax department, the taxpayers can file a complaint

on the efiling of income tax return

website. Likewise, if your ITR is processed but you can't find the intimation

notice in your email, then you can raise a service request for the same.

ITR Filing process includes the estimation of any errors, internal and external inconsistencies, tax & interest calculation and verification of tax payment

ReplyDeleteThank you for sharing. I found it very useful.

ReplyDelete--

We provides Best GST Registration In Chennai, Reach us now to avail this service at low price.

You can use this free income tax calculator to calculate your Income Tax. Depending on your income, you are liable to pay Income Tax to the government, so this calculator can help you calculate your Income Tax so that you don't get any surprises and plan accordingly.

ReplyDelete